You are an expert in your field and that expertise has built your success. But what happens when you want to expand? Or if your growth plateaus? What if market changes force a pivot? How do you know what to do then?

Market research for architects, engineers, and construction firms (AEC) can:

– inform strategy

– reveal opportunities

– provide validation for current plans

– prevent costly investment in non-starters

– empower you to become the disruptor

If you are new to using market research or if you simply want to get more out of it, this article is your ultimate guide to what it is, what it can do for you, what it looks like (with examples) and how to go about it right now in 2023.

What is market research for AEC?

Market research is about gathering information to help you make decisions. But our favorite definition for market research in the context of architecture, engineering, and construction is:

The answer to a question that informs action with a defendable why.

Start by defining your question

The question you want to answer frames the purpose of the information. It is the compass that keeps you on point in a sea of facts and anecdotes.

For example, Company A wants to know if data centers are a viable new market. There is a plethora of information available such as who is building data centers and where the centers are being built. But if Company A specializes in environmental noise control, then the only data centers that are potential projects are those being built in areas that fall under noise ordinances. Other data centers are irrelevant.

Starting with the question: How many data centers are planned near populated areas? shapes the research. If the research shows that most data centers are built outside of populated areas, then choosing not to enter that market has a defendable why.

Quantitative vs. qualitative research

When discussing market research in the AEC space, people often differentiate between quantitative research (hard numbers like demographics and construction dollars spent in a market); and qualitative research (ideas and concepts).

For example, one of our clients active in SciTech and Healthcare wanted to know how many National Institutes of Health (NIH) grants there are and where they were focused. Those are specific data points. Quantitative research. Another data point relevant to them? In the next 10 years, there will be 17.1 million more retirees in the US than there are today.

But what do you do with those data points?

That’s where qualitative research on the ideas and concepts comes in.

Qualitative research for this client explored the likely paths on healthcare reform, opinions on a lack of senior housing, and the crisis in healthcare staff to determine potential futures in healthcare facilities, senior living, and Ed-Med construction.

We researched who is doing what at a large and small scale, all the while looking for ways that they could lead the way in solving the coming challenges through the built environment.

What market research can do for AEC firms

How market research can help you plan for the future

Information can be a powerful tool. But, part of the picture is understanding the underlying drivers for that information to be able to make effective use of it in your real-time decisions.

For example, most consensus reports show that corporate/commercial work is going up, but if that is all you know, how do you know if you have a role to play?

A recent research project for a client showed that new-build headquarters outside of in-migration markets are sharply declining. The activity is within existing building stock which means the work is tenant finish-out and not build-to-suits.

If you look at the data “Commercial is going up” without digging deeper, you could make a critical mistake in where you allocate resources.

Another helpful example is with one of our clients active in SciTech. In North America, there is a lot of research around bio science. These labs are usually at universities, in major pharma companies, or in partnerships between the two. The funding for these labs–whether by universities, pharma, or the National Institutes of Health–drives where these labs are built.

Our work focused on providing customized data on the cities with major universities and pharma companies to inform the hypothesis on future potential bio science projects.

How market research can help you create buy-in for your ideas

Many leaders of AEC firms run on intuition. Their deep experience and understanding of the markets they work in have honed their insight on what moves to make when. It’s created the success that puts them at the top of their markets. The challenge comes when they have to create consensus around their intuition (or when an unforeseen market force disrupts established patterns).

Whether you are planning the future strategy of the firm, a market, a region, or an office, you can build consensus using information.

Research can validate your ideas and back up your intuition to help you sell it to a team. (And if it doesn’t back up your hypothesis, then you save your credibility by knowing to take a different path.)

How market research can help you debunk internal myths

Sometimes firms miss out on market trends because internal myths cause people to miss them.

One of my favorite myths starts like this: “Competitor A gets ALL that client’s work. We don’t need to spend time investing in business development with them.”

What if in fact, your firm hasn’t pursued work with that client in 3 years so you missed that the decision-maker left and new firms are working with them now? Research can reveal that detail.

What about the myth that a market is cooling because someone on a contracting team heard that rumor from an architect? While it is important for a contractor to watch architectural firms’ backlogs, it is critical to understand what is happening within their own company.

How to think about market research to achieve growth

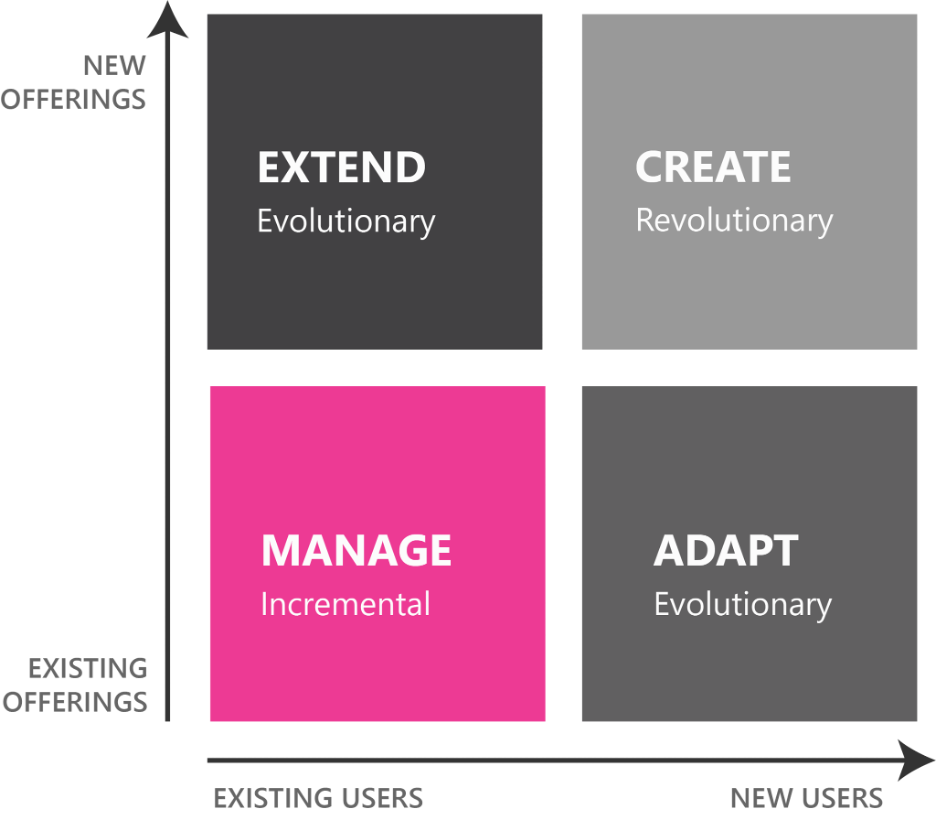

Diego Rodriguez and Ryan Jacoby from IDEO came up with a simple matrix to show organizations ways to grow. We find it a particularly helpful framework for looking at market research to strategize growth.

Using market research to manage your growth–looking at your existing services and clients, you can pull data to examine client satisfaction, observe competitors, check market sizing, or watch for disruptors.

When you want to extend your growth by offering new services to existing clients, you are often looking at the same research to evaluate client satisfaction (it’s hard to sell new things to unhappy clients); competitors (if your competitors are successfully offering the new services, you probably can too); market size (too small of a market creates risk); or disruptors (which can work for or against the new services you are considering).

When you want to adapt your existing services to new clients you will be looking at market size and growth, development of customer personas, competitor analysis, and identification of strategic partners.

If you decide to create something new (new services to a new client base) you will need data on high level market trends and potential disruptors.

Using the manage, extend, adapt, and create lens can be an effective tool to focus the conversations with your team and shape the type of research needed to inform your growth strategies.

Market research examples for AEC

A critical part of a research project is how you communicate your findings. You can take your leadership down the rabbit hole, but they may swirl all the way out the door without a single decision made.

Simple, visual techniques (much like we create to help clients digest information) are the tools you need in your kit. Here are 3 top techniques:

Quantitative dashboards

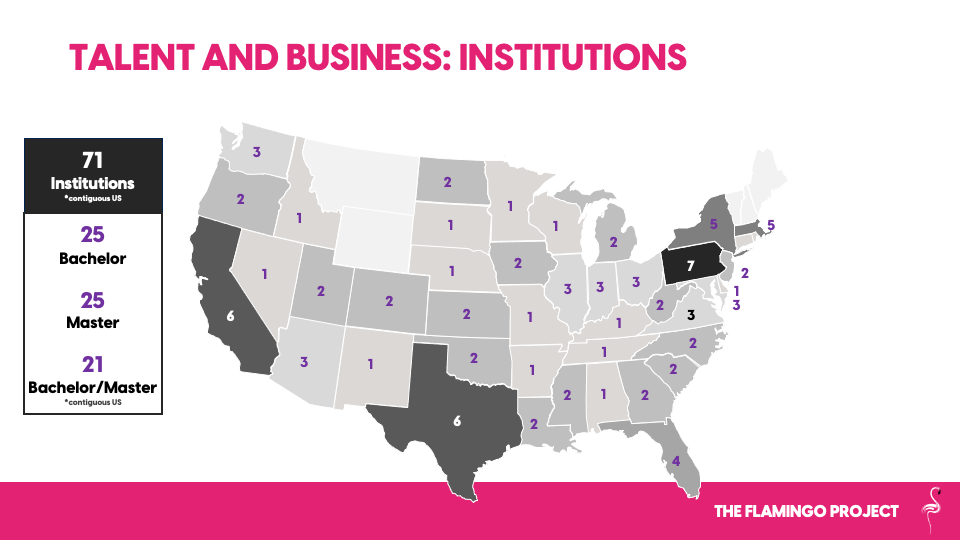

Dashboards help people process the results of complex data at a glance. They also help people visualize comparisons quickly.

For example, a dashboard can help a team process the information on a state quickly.

Dashboards can also serve as scorecards.

Heatmaps

Heatmaps can be literal maps of the geography or rankings of points of importance. They help people visualize valuation criteria for an idea or advantages of some locations over others.

This heatmap shows how different markets compare based on points of importance designated by the client.

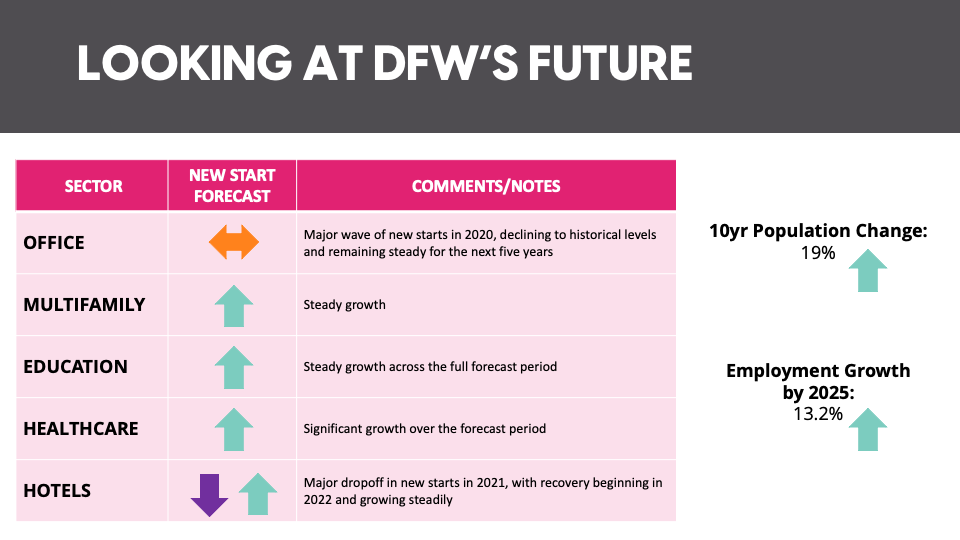

Red / Yellow / Green Light

Culturally, we understand the meanings of red, yellow, and green in the context of traffic. Up/down and flat arrows are also well understood.

When considering strategy and where future work will come from, is the news good, neutral or bad? And WHY? This is a wonderful way to summarize your findings for sectors, geographies, or potential partners.

Where to find industry trends for AEC markets

You can hire a firm like The Flamingo Project to work with you to shape and deliver research projects, or you can do your own market research. Here are some of the resources we use:- The Beige Book – Eight times a year, the Federal Reserve Bank reports on current economic conditions via anecdotal information from Bank and Branch directors along with interviews from key business contacts, economists, and market experts.

- The Urban Land Institute publishes Emerging Trends in Real Estate and other market analysis.

- Commercial real-estate firms often share their market trends online, like the Cresa Reports.

- The US Department of Education shares data and statistics for colleges/universities and K-12 trends. If you work regionally, you can go granular and research universities and school districts via the local websites.

- States and municipalities share a lot of data online. Most also have active social media profiles you can use to track the topics important to them.

- The National Institutes of Health provides information about grants and funding.

- Think tanks like Deloitte and McKinsey publish insights on economic and social trends.

- The Associated General Contractors of America (AGC) publishes a weekly one-page summary of economic news relevant to construction. They also offer fact sheets by state.

- The National Multifamily Housing Council (NMHC) publishes research on the apartment industry and development activity.

How to hire a firm to conduct market research for you

When you hire a firm like The Flamingo Project, you aren’t looking for “off the shelf” market research. You are looking for a team who will work with you to craft the questions you most need answered and protect you from going down “rabbit holes” that aren’t useful.- Common questions AEC firms want answered include:

- Where do we grow next?

- How do we make sure we aren’t missing out in our current markets?

- Why are we losing?

- Is this a market we need to be in?

- What’s our ROI timeline?